Here’s a clear, numbers-first way to think about your “total U.S. ban on outsourcing to India” scenario. It’s hypothetical, so I’ll use the best current market sizes and cite sources, then do back-of-the-envelope math.

1) How big is the India→U.S. tech/services exposure today?

- India’s tech industry revenue in FY2024 ≈ $254B, with ~$200B in exports. IBEF

- Historically the U.S. accounts for ~60% of India’s IT-BPM export revenue. StatistaReuters

- So India’s annual software/IT exports tied to U.S. demand ≈ $120B (60% × ~$200B).

GCCs (U.S. companies’ captive centers in India) are also huge:

- ~1,700+ GCCs in India; ~$64.6B export revenue; ~1.9M employees (FY24). The Economic TimesNasscom

- NASSCOM notes exports are now roughly split 50/50 between global MNCs (incl. GCCs) and Indian service providers. nasscomYourStory.com

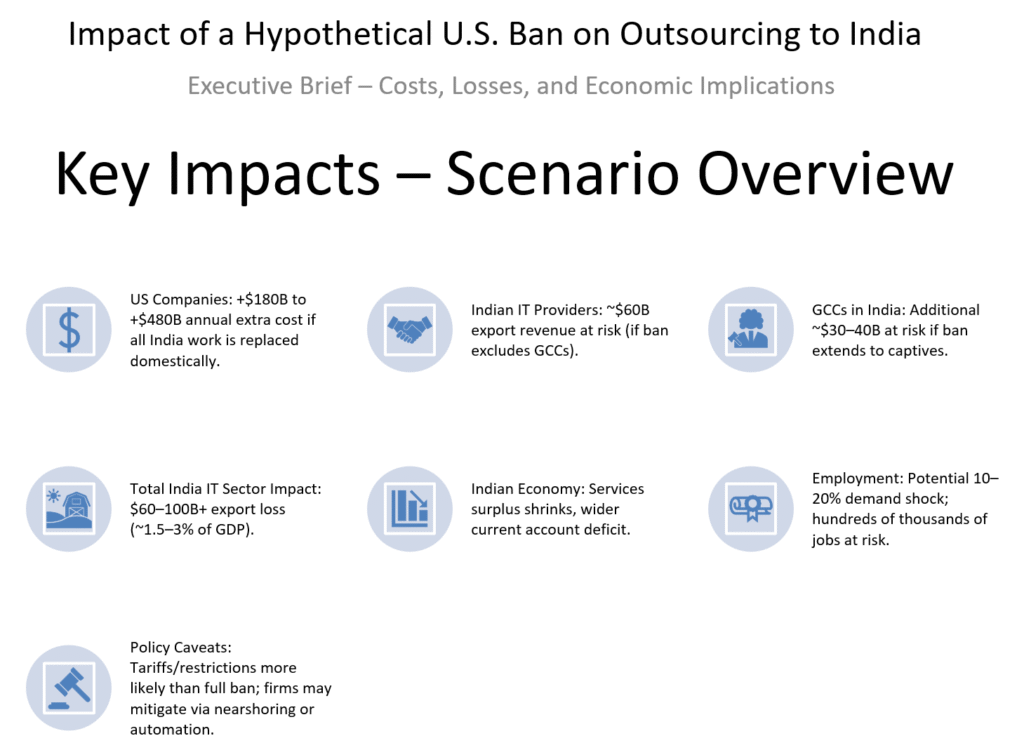

2) Cost impact on U.S. companies (if all India work must move onshore)

Typical reason firms go to India: ~60–80% cost savings vs U.S. roles. Insignia Resource

If $120B of India work gets relocated to the U.S.:

- At 60% savings today, India cost ≈ 40% of U.S. cost → U.S. replacement cost = 120/0.40 = $300B, i.e., +$180B annual cost increase.

- At 80% savings, India cost ≈ 20% of U.S. cost → U.S. replacement cost = 120/0.20 = $600B, i.e., +$480B annual cost increase.

Ballpark: +$180B to +$480B per year in additional operating costs for U.S. firms, depending on mix of work and wage differentials. (This ignores productivity differences and transition/penalty costs, which would push higher.) Insignia Resource

3) Impact on Indian IT companies

Two versions of the “ban” matter:

A) Ban on buying services from India (but GCCs can still operate in India):

- Immediate hit is mainly to Indian service providers’ U.S. revenue (a big slice of that ~$120B).

- If we assume half of the $120B is with Indian providers (the rest via GCCs), direct provider revenue at risk ≈ $60B. YourStory.com

B) Ban that also forces U.S. firms to stop using India-based GCCs:

- Then add much of GCC export revenue tied to U.S. parents (a large share of the $64.6B). A 50–60% U.S. share would put $32–39B more at risk.

- Combined at-risk annual exports could approach $90–100B+ for India’s tech sector under a strict interpretation.

Either way, listed Indian IT firms would see material revenue compression; margin pressure would be severe given limited short-term demand substitution.

4) Impact on India’s macroeconomy

- Services exports/surplus are a pillar of India’s external accounts: FY24 net services receipts ≈ $162.8B; total services exports (FY25 est.) ~$383.5B. Software/computer services are a major share. Press Information Bureau+1

- Removing ~$60–120B+ of software exports would shrink the services surplus dramatically, risking a larger current account deficit (recent improvement was heavily supported by services exports). Reuters

- IT-BPM contributes ~7–8% of India’s GDP; a shock of ~$60–100B in exports translates to a ~1.5–3% of GDP drag (very rough), plus second-order effects on urban consumption, real estate, and tax receipts. Wikipedia

- Employment risk: Indian tech employs ~5.43 million; a large portion serves U.S. clients. Even a conservative 10–20% demand shock could put hundreds of thousands of jobs at risk over 12–24 months. nasscom

5) Important caveats (why the actual hit could be lower or delayed)

- Workarounds: Nearshoring (Mexico/LatAm), onshoring via GCC migrations (if allowed), shifting scope to non-U.S. clients, or increased automation could soften the blow over time. Business Today

- Policy scope: Many “outsourcing bans” end up as tariffs/restrictions rather than absolute bans; tariffs raise costs but don’t zero out demand. (There’s active chatter about U.S. tariffs on software exports right now.) The Economic TimesThe Times of India

Quick take

- U.S. companies: expect +$180B to +$480B per year in extra cost if all India-sourced work must be replaced domestically. Insignia Resource

- Indian IT sector: $60–100B+ annual export revenue at risk depending on whether GCCs are included. IBEFThe Economic TimesYourStory.com

- Indian economy: meaningfully weaker services surplus, a wider current account deficit, GDP drag ~1.5–3% (rough), and employment stress in the tech hubs. Press Information Bureau+1Wikipedianasscom